I opened the paper today and saw this from Paul Krugman, on

Jack Welch, the former chairman of General Electric, who posted an assertion on Twitter that the [recent unemployment data] had been cooked to help President Obama’s re-election campaign. His claim was quickly picked up by right-wing pundits and media personalities.

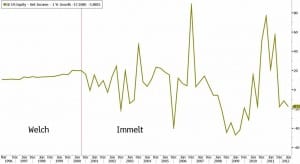

It was nonsense, of course. Job numbers are prepared by professional civil servants, at an agency that currently has no political appointees. But then maybe Mr. Welch — under whose leadership G.E. reported remarkably smooth earnings growth, with none of the short-term fluctuations you might have expected (fluctuations that reappeared under his successor) — doesn’t know how hard it would be to cook the jobs data.

I was curious so I googled *general electric historical earnings*. It was surprisingly difficult to find the numbers! Most of the links just went back to 2011, or to 2008. Eventually I came across this blog by Barry Ritholtz that showed this graph:

That looks pretty fishy, indeed. Also a link to a news article from 2002 (shortly after Welch stepped down from running GE) that said:

GE used to feature on university courses as a model of probity. These days, it crops up in the seminars about earnings-manipulation. Everyone agrees that GE practises one form of earnings management: it times one-off asset sales to coincide with one-off write-downs or restructurings. . . . Beyond this, the amount of profits-smoothing that GE indulges in is a matter of speculation. GE also manages expectations about its earnings by managing its analysts. . . . managers who are in the habit of smoothing earnings have an especially strong motive to keep the good news coming, whether or not the business warrants it.

Yup. Also this from Marie Leone and Tim Reason:

[In 2009,] after a four-year investigation, GE settled accounting fraud charges with the SEC for allegedly misleading investors with improper hedge accounting and revenue recognition schemes. Specifically, GE was charged with violating accounting rules when it changed its original hedge documentation to avoid recording fluctuations in the fair value of interest rates swaps, which would have dragged down the company’s reported earnings-per-share estimates.

In addition, the SEC charged GE with concocting schemes to accelerate the recognition of revenue from its locomotive and aircraft spare parts business, to make the company’s financial results appear healthier than they actually were.

Without admitting or denying guilt, GE paid a fine of $50 million, and agreed to remedial action related to internal control enhancements. “GE bent the accounting rules beyond the breaking point,” noted Robert Khuzami, director of the SEC’s Division of Enforcement, in a statement.

OK, fine. This isn’t my area of expertise and, in any case, our circulation is on the order of 1/10,000th of Krugman’s, so why report it here?

What’s interesting to me are the different attitudes on statistical manipulation. The Bureau of Labor Statistics, Census Bureau, etc., take their data pretty seriously and I agree with Krugman that it’s hard for me to imagine them manipulating the numbers in any way. For one thing, don’t have much incentive to do so: as Krugman notes, they are civil service workers, not political appointees. And it’s not like better numbers would increase their budget line. (In contrast, I can understand the motivation for those military guys who faked the data on missile tests: success can lead to more funding.) Beyond this, it just doesn’t seem that this sort of fraud is part of the culture of government statistics in the United States.

In contrast, Leone and Reason report:

The SEC complaint relates several instances of round-robin email discussions among GE accountants, internal auditors, executives, and the company’s external auditor, KPMG, debating whether aggressive accounting would past muster with regulators.

So, it’s not about Welch being some sort of data sociopath; rather, data manipulation is part of corporate culture. And, indeed, these guys have lots of motivation to fake the numbers (i.e., “aggressive accounting”). The executives and accountants personally make millions of dollars from it. Millions of dollars in win, very little personal risk if you get caught (it was GE that paid the fine, right? Jack Welch is still at loose on Twitter): that’s what I call an incentive.

One reason this interests me is the connection to ethics in the scientific literature. Jack Welch has experience in data manipulation and so, when he sees a number he doesn’t like, he suspects it’s been manipulated. In academia, Steven Levitt has seen economists “work behind the scenes constantly trying to undermine each other” and been involved with a journal that suppressed unwelcome research results and so, when he has a paper rejected (by a different journal), he suspects the rejection was for illegitimate reasons. I don’t think such a thing would be done in the field of statistics, because I think we have more of a tradition of going with the data.